Over the past years, crossovers of artificial intelligence and cryptocurrency have become increasingly central in the financial worlds. In this manner, while digital money is becoming more popular due to the help of AI, it is only in this way that trading methods can improve, security can be ensured, and market predictions can be more accurate. This long article aims at discussing how AI affects cryptocurrency, its uses, advantages, and future possibilities.

What Is AI and How Does It Integrate with Cryptocurrency?

Artificial Intelligence is the power of a machine to act like an intelligent human being. In total, it includes learning, reasoning, and the self-correction of its own mistakes. Its technologies range from machine learning to natural language processing, and finally, including neural networks that help machines in doing things which require smartness.

Cryptocurrency is a class of digital or virtual money that uses cryptography for security. The cryptocurrencies are created on a blockchain network, but they are intangible. Such a system provides transparency and decreases the involvement of central organizations that are usually involved in the setup of banks.

Cryptocurrency and AI are a powerful couple; the former can operate, as well as analyze, a large amount of data—great for the unpredictability of the cryptocurrency market. Hence, they together are the game changer, together shaping this new way of dealing with finance in a digital world.

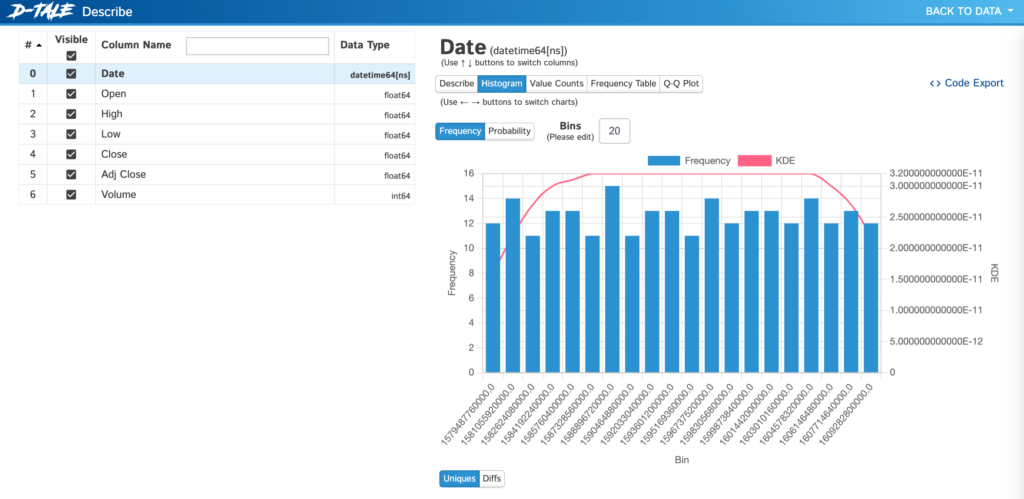

AI in Cryptocurrency Trading

Automated Trading Algorithms

Probably the most significant application of AI to cryptocurrency is developing automated trading algorithms. These algorithms involve machine learning, which helps it perform an analysis of historical market data for patterns and ultimately arrive at an autonomous execution of trading with no human intervention. Automated trading has many benefits:

Speed and Efficiency: AI-powered trading bots can execute a trade in mere seconds—much faster, theoretically, compared to human traders. This goes a long way toward making them effectively catch instantaneous opportunities and change strategies on time.

Consistency: AI has no feelings of becoming tired, scared, or greedy, which injects higher discipline into the trading strategies and reduces the likeliness that a decision is made in a hasty manner.

Data Analysis: AI can process and analyze vast amounts of data, which includes historical prices, how much was traded, and even sentiments from new articles. Such deep study helps in better trading decisions.

Case Study: Numerai Basically, Numerai is a hedge fund for cryptocurrency that leverages AI and machine learning in investment. It pools predictions from all the different data scientists in the world, mixing varied ideas into one solid trading strategy. It is this very methodology that allows each individual AI model to handle the fiddly knowledge of models about the cryptocurrency market.

High-Frequency Trading (HFT)

AI also assists in high-frequency trading; this is a large number of trades within the shortest time possible. A core application of AI in HFT strategies is the analyzes market data and makes rapid decisions to trade, sometimes as fast as milliseconds.

Advantages of HFT

Market Liquidity: The higher market liquidity brought about by HFT can have the influence of reaping narrower bid-ask spreads and more efficient price discovery. Arbitrage Opportunities: AI-driven high-frequency trading strategies can take advantage of price differences between various markets or exchanges, seizing arbitrage opportunities that come up.

Challenges:

Market Impact: HFT can help make buying and selling easier, but it can also cause bigger price changes and more market ups and downs.

Several regulatory challenges relate to high speed and the complexity of HFT strategies, to which authorities are always considering how to attend.

Enhancing Security with AI

Fraud Detection and Prevention

Security is a very major component of the cryptocurrency universe because of all the illegal activity and scams that go on. Through observing transaction patterns and detecting unusual activity, AI does much by finding and curbing fraud.

How AI Finds Fraudism

Pattern Recognition: Applications check the history of transactions for a pattern suggesting fraud occurred. Examples includes identifying unusual quantities of transactions, sudden changes in account activities, and sundry red flags. Real-time monitoring: AI systems have the capacity to monitor transactions in real time, increasing suspicious activity identification with immediate mastery to help stop possible fraud quickly.

Case Study: Chainalysis

Chainalysis is the industry leader in blockchain research and applies AI techniques to secure cryptocurrency. The company informs transaction patterns immediately, traces illegal activities, and informs fraud to the business and law enforcement for them to help keep the market honest.

Cybersecurity Enhancements

AI plays a very significant part in cryptocurrency cybersecurity, particularly in the detection of fraud. AI systems enhance cybersecurity by:

Network Traffic: AI systems observe network traffic for any anomalies or other forms of threats.

Vulnerability identification: AI can find vulnerabilities in software and systems to allow time for patching in order to mitigate risks.

Response to Threats: AI can automatically respond to a threat by isolating or shutting down affected systems.

Predicting the Market with AI

Predictive Analytics

Predictive analytics is where AI can and does bring a lot into the cryptocurrency markets. The latter would include historical data, statistical algorithms, and machine learning techniques to be able to identify future market trends and price movements.

Uses of Predictive Analytics

Price Forecasting: AI analyzing past price data and other market parameters can predict future trends in prices. This helps the trader and investor make more informed decisions. Trend Analysis: This AI retraces emerging market trends and patterns that are probably very hard to discover with ordinary active analysis.

Case Study: Augmentum Fintech

Augmentum Fintech uses AI in automated market trend analysis for real-time insight into their cryptocurrency investments. With predictive analytics, Augmentum Fintech helps people surf through the turbulence in the cryptocurrency market with a touch more confidence.

Sentiment Analysis

Sentiment analysis forms the powerful underpinning of AI in cryptocurrencies, through analyzing social media and new postings or any other opinions publicly available on market sentiment.

How AI Does Sentiment Analysis

Text Analytics: AI applications also monitor the tone of words used in news and social media posts to determine the mood of a story—whether it is good, bad, or indifferent. Trend Identification: By tracking how emotions are changing over time, AI can find new trends and potential shifts in existing market trends.

Case Study: The Necktie

The Tie is a platform that employs AI to study crypto-related news and social media. By feeling the market, The Tie allows traders and investors to quickly gauge market potential comprehensively in making more informed decisions.

Smart Contracts and AI

Automating Contracts

The set of contracts that execute themselves with the rules codified can be termed smart contracts. Smart contracts are improved with AI by automating challenging tasks and reducing the requirement for human intervention.

AI Benefits in Smart Contracts

Efficiency: AI performs deals by executing adherence checks and contracting; therefore, more, faster, and better processing has been attained.

Accuracy: Automation minimizes the chances for human error and also realizes the terms of the contract as intended.

Case Study: OpenLaw OpenLaw is a platform that creates and manages smart contracts, using AI and blockchain technologies. That means, through OpenLaw, AI will be used to automate creating, executing, and enforcing contracts, hence quite simple to work with.

Auditing and Verification

This means that AI also stands for smart contract auditing and verification: AI algorithms go through the code of the contracts and transaction history in contracts to ensure everything operates as expected, and under pre-agreed terms.

How AI Emppowers Auditing

Code Analysis-if AI tests the code of smart contracts for bugs, flaws, and inconsistencies.

Transaction Monitoring: AI follows the transactions of smart contracts, making sure they are really doing what the contract says.

Use Case: Quantstamp is an AI and blockchain-powered smart contract auditing firm. The mission of the company is to secure and prove the reliability of smart contracts across the entire cryptocurrency space through a comprehensive audit and verification process.

Enhancing Customer Support with AI

Chatbots and Virtual Assistants

AI-powered chatbots and virtual assistants are becoming increasingly common in the cryptocurrency industry. These tools provide round-the-clock customer support, handling inquiries, troubleshooting issues, and offering guidance on various aspects of cryptocurrency management.

Benefits of AI in Customer Support:

- 24/7 Availability: AI chatbots provide continuous support, addressing customer inquiries and issues at any time of day.

- Efficiency: AI chatbots handle routine tasks and common questions, freeing up human support agents to focus on more complex issues.

- Personalization: AI can analyze user data to offer personalized recommendations and assistance.

Case Study: BitBot

BitBot is an AI-powered chatbot designed for cryptocurrency exchanges. By handling customer inquiries and providing support, BitBot enhances the user experience and helps exchanges operate more efficiently.

Personalized Assistance

AI also enables personalized customer support by analyzing user data and behavior. This customization enhances the user experience by offering tailored advice and recommendations based on individual needs and preferences.

How AI Provides Personalized Assistance:

- Behavior Analysis: AI analyzes user interactions and preferences to offer personalized recommendations and support.

- Tailored Communication: AI can customize responses and advice based on user history and behavior.

Case Study: CoinBase

CoinBase uses AI to provide personalized support and recommendations to its users. By analyzing user behavior and preferences, CoinBase enhances the overall customer experience and helps users navigate the cryptocurrency platform more effectively.

Navigating Regulatory Compliance with AI

Monitoring Transactions

Compliance with regulatory requirements is crucial in the cryptocurrency space. AI assists in monitoring transactions to ensure they adhere to legal and regulatory standards, such as anti-money laundering (AML) and know your customer (KYC) regulations.

How AI Helps with Compliance:

- Transaction Monitoring: AI systems analyze transaction data to detect suspicious activities and ensure compliance with AML and KYC regulations.

- Risk Assessment: AI assesses the risk level of transactions and flags those that may require further investigation.

Case Study: ComplyAdvantage

ComplyAdvantage is a company that uses AI to monitor transactions and ensure regulatory compliance in the cryptocurrency industry. By providing real-time insights and risk assessments, ComplyAdvantage helps businesses adhere to legal requirements and prevent financial crimes.

Automating Reporting

AI also simplifies the process of generating compliance reports. By automating data collection and analysis, AI reduces the administrative workload and ensures timely and accurate reporting to regulatory bodies.

Benefits of Automated Reporting:

- Efficiency: Automation speeds up the process of generating compliance reports and reduces the risk of errors.

- Accuracy: AI ensures that reports are accurate and up-to-date, helping businesses meet regulatory requirements.

Case Study: Trulioo

Trulioo uses AI to automate compliance reporting and verification processes. By streamlining data collection and analysis, Trulioo helps businesses efficiently manage their regulatory obligations and maintain compliance.

Managing Risk with AI

Analyzing Volatility

Cryptocurrency markets are known for their volatility, and AI plays a crucial role in analyzing and managing this risk. AI algorithms assess market conditions and identify potential risks, helping investors and traders navigate the unpredictable nature of digital currencies.

How AI Analyzes Volatility:

- Historical Data Analysis: AI examines historical price data to identify patterns and predict potential market fluctuations.

- Risk Assessment: AI evaluates various risk factors, such as market sentiment and external events, to assess their impact on volatility.

Case Study: Skew

Skew is a platform that uses AI to analyze cryptocurrency market volatility. By providing real-time insights and volatility forecasts, Skew helps traders and investors manage risk and make informed decisions.

Optimizing Portfolios

AI also assists in portfolio optimization by evaluating various risk factors and market conditions. AI models recommend adjustments to investment portfolios, aiming to maximize returns while minimizing risk.

Benefits of AI-Driven Portfolio Optimization:

- Risk Management: AI assesses risk factors and adjusts portfolio allocations to mitigate potential losses.

- Return Maximization: AI identifies investment opportunities and optimizes portfolio performance to achieve higher returns.

Case Study: Wealthfront

Wealthfront uses AI to optimize investment portfolios for its clients. By analyzing market conditions and risk factors, Wealthfront provides personalized recommendations and manages portfolios to achieve optimal performance.

The Future of AI in Cryptocurrency

Emerging Trends

As AI technology continues to advance, its applications in cryptocurrency are expected to grow. Emerging trends include:

- AI and Blockchain Integration: Deeper integration of AI with blockchain technology for enhanced security and efficiency.

- Advanced Predictive Models: Development of more sophisticated AI models for market analysis and prediction.

- Decentralized AI Solutions: Exploration of decentralized AI solutions for improved data privacy and security.

Challenges and Considerations

While AI offers numerous benefits, it also presents challenges. Key challenges and considerations include:

- Data Privacy: Ensuring the privacy and security of user data in AI-driven systems.

- Algorithmic Bias: Addressing potential biases in AI algorithms that could impact decision-making.

- Ethical Implications: Considering the ethical implications of automated decision-making and AI’s role in financial markets.

Conclusion

The integration of AI in cryptocurrency represents a groundbreaking shift in the financial landscape. From revolutionizing trading practices and enhancing security measures to improving market predictions and regulatory compliance, AI is making a profound impact on the world of digital finance. As technology continues to evolve, the collaboration between AI and cryptocurrency promises to drive even more innovation and transform how we interact with digital currencies.

- Revolutionizing Medical Imaging: How AI’s ScribblePrompt is Transforming Diagnostic Accuracy - September 16, 2024

- Unlocking AGI: How Supercomputing is Paving the Way for Human-Level AI - September 11, 2024

- How AI is Transforming the iPhone 16: A Deep Dive into Its Revolutionary Features - September 10, 2024